-

What Is the Role of an Executor In Probate?

To ensure that your family is adequately protected after your passing, it’s important that you speak with a probate law attorney. As you and your lawyer discuss your will , you will need to decide who to name as your executor; that individual whom you trust to carry out the terms of your will. The Woodlands probate law attorney, Andrew J. Bolton, will gladly discuss the role of executors in further detail.

In short, after a person dies, an executor must organize and wrap up the deceased’s affairs. This involves settling debts, preserving property, distributing inheritance, and taking care of various legal matters. An executor need not necessarily have to be a financial or legal expert, but can be a trusted family member. If you have a will, the executor’s primary job will be to follow the directions laid out in your will. If an individual does not name an executor before passing away, the court will appoint one.

-

Moving To Texas?

Welcome to Texas! Most newcomers find that, apart from our sometimes cranky weather, Texas is perhaps the best state in which to reside. Texas has low taxes, low regulation, low prices, and one of the country’s easiest probate systems! But to take advantage of our fast and easy probate process, it is often necessary to update your will to obtain the benefits of a Texas probate.

As with most things in the legal arena, there are often certain “magic words” which must be used in order to fast track and simplify the probate of your will. Whether you are young and just starting out, or whether you are closer to retirement than most, a redraft of your will can result in peace of mind–before and after you are gone.

It’s important if you are moving in from another state to seriously consider a will redraft. Although I’m not 100% certain, I hear that a will redraft is much harder after you are gone!

Contact us for an inexpensive review of your will. If one is not needed, we will tell you. If a redraft is in order, then it is the most cost-effective way of gaining peace of mind.

-

Creating a Will or Trust

Wills and trusts in the Woodlands dictate what happens to a person’s assets and estate after death. While most people refer to an attorney who helps in these situations as a will attorney or a probate lawyer, they are actually called estate-planning attorneys. When someone decides to create a will or a trust, consulting with a lawyer can ensure that he or she achieves certain estate-planning goals.

In this video, an attorney details the many benefits of working with a lawyer during the estate-planning process. As he explains, a lawyer understands the best avenues for allocating assets following death. For example, a lawyer can help explain when a trust or will is the most effective means to allocate assets to family members. Working with an attorney also ensures accurate preparation of documents, so as to ensure smooth probate and estate execution.

-

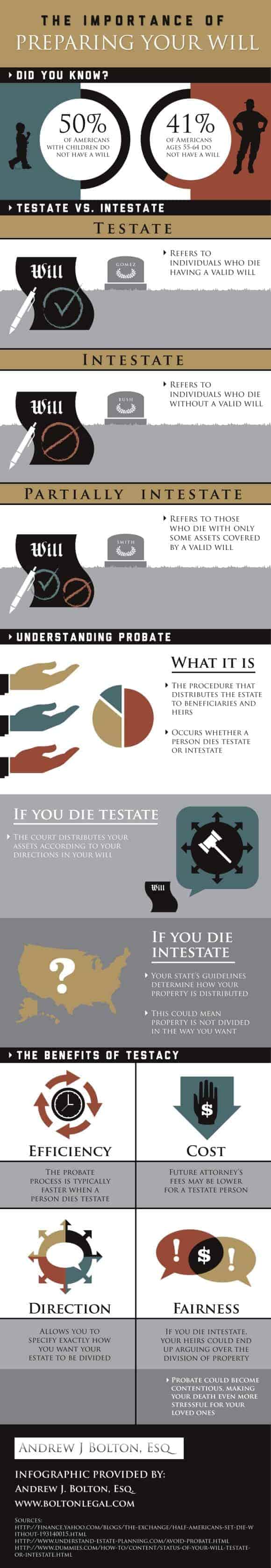

The Importance of Preparing Your Will [INFOGRAPHIC]

Did you know that at least half of Americans with children do not have a will? While thinking about passing away can be difficult, it’s important to take steps to make sure your family and loved ones are taken care of once you are gone. That’s why working with an experienced lawyer in estate planning in The Woodlands is so important. When a person dies testate, this means that he or she has a valid will. If a person dies intestate, there is no valid will, so property and assets are divided up according to state guidelines. Without a valid last will and testament, your property could end up being divided contrary to your wishes. Take a look at this infographic to understand the differences between being testate and intestate. Please share with your friends and family.

-

The Basics of Writing a Will

According to an AARP survey , two out of every five Americans over the age of 45 haven’t written a will. While many Americans may avoid this process because it entails actively planning for their demise, creating a will is one of the most important ways to plan for loved ones. Working with a probate and will attorney in the Woodlands allows someone to put his or her wishes on paper and help his or her heirs avoid unnecessary legal hassles.

What is a will?

A will is a legal document in which someone declares how and who will manage his or her estate after death. This estate can consist of big, expensive items like a vacation home as well as smaller items that hold sentimental value, like family photos. The person appointed to manage the estate is called the executor, as he or she is tasked with executing the testator’s wishes. However, there are certain types of property, like retirement accounts, that aren’t covered by wills. In such cases, the testator should discuss how to transfer ownership in this property with a will attorney. Creating a will also overlaps with other family law areas, as the testator can declare who will become guardian to his or her dependents in the will.Is an attorney necessary?

Contacting a law firm is not required to create a will. However, an experienced will lawyer provides useful advice on estate-planning strategies, such as how to create a living trust within a will. Whether someone decides to create his or her own will, or seeks the advice of a lawyer, he or she needs to consider all essential estate-planning documents. Indeed, this is a great time to research financial and health care powers of attorney.Should you create a joint will?

Will lawyers and estate planners tend to advise against joint wills. In fact, some states don’t even recognize them as legally valid. The problem in joint wills is that it is rare for both spouses to die at the same time. Additionally, many couples have property that is not jointly owned. Even though a couple’s separate wills may look similar, it’s recommended to just create separate legal documents. -

Why You Should Have a Will

There is a common misconception that if you die without a will, your personal belongings will pass to your next of kin automatically. In reality, with or without a will, the probate courts will determine how to distribute your assets, which may or may not be consistent with your true wishes. Avoiding probate in The Woodlands requires you to meet with a will attorney and specify how your possessions should be divided.

Ensure belongings go to beneficiaries

Wills ensure that certain belongings go to desired beneficiaries. Every probate court will review the will for validity and actually having a will, rather than an intestate estate, will speed up the probate process. In meeting with a will attorney, you can also outline how you would like certain assets to be used following your death. For example, you can bequeath a car to a family member and express your wishes that he sell it to support his education. Even though this stipulation isn’t binding, the will allows you to convey your final wishes in giving assets to your beneficiaries.

Limit family disputes

Courts only allow contesting a will in very limited circumstances. Usually, this occurs when there is evidence the will is not legitimate because the person making the will was not of sound mind. By drafting a will, you can help ease tension among family members in dividing your assets. Your will attorney can help you use specific language to ensure there is no doubt or confusion as to how you would like your assets divided following death.Quantify your assets

If you haven’t drafted a will, a probate attorney may send inquiries to local banks and financial institutions to assess your financial situation. Your family members may also have to produce financial paperwork, including brokerage statements, government bonds and stock certificates. The purpose of this requirement is to ensure all of your assets exist and can be divided equitably. Creating a will helps avoid this step because you have formally outlined your assets and provided details of their value. You can also include a contingency clause assigning a beneficiary to any assets that you don’t specifically include in your will.

RECENT POSTS

categories

- Uncategorized

- Estate Planning

- Probate

- Family Law

- Drafting a Will

- Divorce Lawyer

- Texas Family Law

- Divorce

- Real Estate

- Probate Court

- Child Custody

- Andrew J. Bolton

- Esq.

- Adoption

- Law Office of Andrew J. Bolton

- Wills

- Executor

- Infographic

- Guardianship

- Trusts

- Contested Divorce

- Child Support

- Attorney

- Living Wills

- Contested Will

- Prenuptial

- Probate Bond

- Heir Apparent

- Legacy Contact

- Living Trusts

- legal guardian

- Legal Disputes

- property rules

- Common Law

- Stocks

- Estate Tax